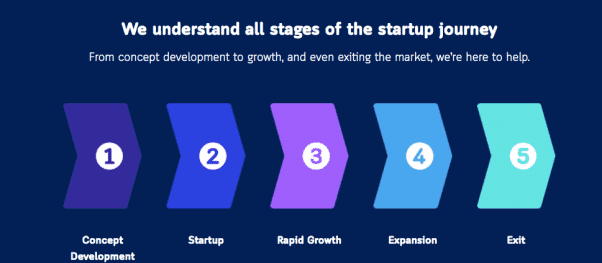

Allied Legal is excited to launch its brand-new service offering. In addition to our startup focused legal services, the firm now offers business development services tailored to help our innovative clients accelerate their growth (https://www.alliedlegal.com.au/expertise/scale-your-business/)!

INDER SINGH – DIRECTOR

As a firm focused on innovation, Allied Legal understands all stages of the startup journey. A key hurdle for emerging businesses is attracting new clients for their products and services. To tackle this issue, we are thrilled to welcome as Director, Inder Singh (formerly of SKALR Group). Inder will head up our business development service offering. He brings over 20 years of experience working in business development and sales with global technology companies. He is passionate about helping startups to scale faster through the delivery of tailored business development and lead generation solutions. His recent expertise includes working with high calibre startup accelerators and disruptive businesses. The results speak for themselves!

Allied Legal has built a strong reputation as a commercially savvy startup focused law firm. We are passionate about helping emerging businesses. We truly believe that our business development services bring a fresh perspective to the sector and will help fast-track the growth of emerging businesses in these otherwise challenging times. You can learn more about our new services here: https://www.alliedlegal.com.au/expertise/scale-your-business/.

We look forward to sharing more about other additions to our team over the coming weeks.

Please contact us at hello@alliedlegal.com.au. We’d love to hear from you.