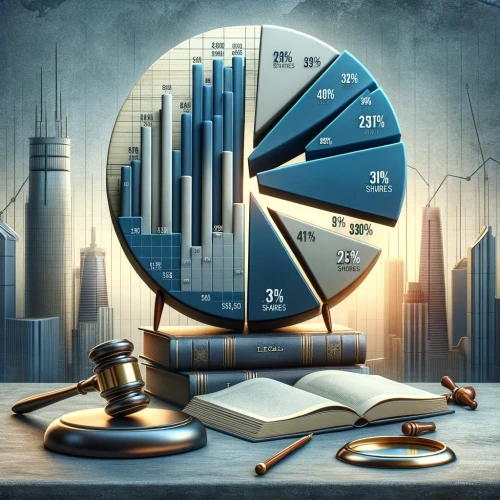

In the dynamic environment of startups, the process of introducing new shareholders can often lead to unintended consequences. Typically, shares in a startup are issued through several mechanisms:

- as part of the initial structure;

- to investors in exchange for capital (ie, a monetary investment);

- via convertible instruments like SAFEs or convertible notes; and

- to employees through an Employee Share Schemes (more commonly known as ESOPs).

- An essential aspect to understand in all these scenarios is the concept of share dilution.

Dilution occurs when a company issues new shares, reducing the ownership percentage of existing shareholders. While dilution can decrease individual shareholders’ control and earnings per share, it often accompanies valuable company growth and investment opportunities. Understanding how dilution works in different scenarios is crucial for startups to navigate their growth successfully.

Initial Structure

When a startup is set up, there is no dilution initially as the agreed share structure is implemented. It is important to remember that if you have agreed equity splits with co-founders already in place at the time you set up your company, the new company shareholding should reflect these arrangements. It will be far more convenient for all original founders to have their shareholding in place from day 1, and this initial share structure sets the baseline from which future dilution will occur through subsequent share issuances.

It’s important to note that in Australia, companies cannot hold shares in themselves, meaning there’s no concept of reserving or setting aside shares at this stage. Therefore, when you set up, the original shareholders should all own that number of shares that reflects the intended holding.

Equity Investment

As stated above, shares cannot be set aside for future allocation. Therefore, when a company brings on an equity investor, it (generally) issues new shares to investors which increases the total number of shares. You may have had 1,000 shares between 4 founders when you set up, then you issue 100 to a shareholder. This results in 1,100 shares on issue, thereby diluting existing ownership percentages.

When introducing new investors, other than where an existing shareholder is seeking to exit the company, it is generally preferable to issue new shares (ie, rather than transfer them). Transferring shares can lead to unintended consequences such as:

- You will likely be hit with a capital gains tax consequences, as this constitutes a disposal of an asset;

- Further, on paper, the value of the investment is paid to you, not the company.

- From a dilution perspective, only you would be diluted, but the shareholders should (generally) all be diluted equally in an equity investment.

While dilution reduces ownership percentage, the investment should increase the company’s overall value, potentially making a smaller ownership percentage more valuable. Most startups will raise multiple times as part of their journey, so it is important to keep this in mind in early rounds. You don’t want to dilute yourself too heavily, too early, and find yourself a minor shareholder before you’ve finished your funding rounds.

SAFEs and Convertible Notes

Under SAFEs and convertible notes, investors pay upfront but receive shares later, typically during a larger equity investment round. One of the benefits of these types of instruments is that they delay the need for a company valuation, as the investment converts based on the valuation at the triggering event.

The number of shares to be issued under SAFEs and convertible notes must be considered during the triggering equity investment round to avoid unexpected dilution. New investors will typically want to be topped up so that they are not diluted by outstanding SAFEs, so the number of shares to be issued through SAFEs and convertible notes is usually taken into account when calculating the number of shares to be issued to investors.

We have heard stories (likely cautionary tales, but pertinent nonetheless) of a founder who diluted himself out of his own company because he didn’t keep track of how many shares would be issued when several SAFEs all converted at once.

Our friends at CAKE have helpful dilution modelling tools which founders can use to calculate their dilution, taking convertible instruments into account when they do so.

ESOPs

Under employee share schemes, employees are generally either issued shares or options. Direct share issuance to employees causes immediate dilution, so understanding dilution is fairly straightforward.

When options are issued, the employee is granted a right to be issued shares at a future time. As mentioned above, there is no reserving shares in Australia. Therefore, the concept of an option pool is something which only exists on paper. Like in the case of convertible instruments, investors will typically expect any outstanding options to be taken into account when calculating the number of shares to be issued to them under an investment, to ensure they are not diluted when that option is exercised.

Conclusion

Navigating shareholder dilution is a critical aspect of managing a startup. Understanding how each method of share issuance affects ownership and control is essential for making informed decisions. Whether through initial setup, equity investments, SAFEs and convertible notes, or ESOPs, the key lies in striking a balance between necessary dilution for growth and maintaining significant control and value in the company. Awareness and strategic planning can ensure that dilution is a tool for growth, rather than an unintended setback.

Our team of commercial law experts at Allied Legal can help, as we have a wealth of experience with structuring equity and assisting with issues around dilution. You can connect with one of our commercial law experts by giving us a call on (03) 8691 3111 or emailing us at hello@alliedlegal.com.au.