Are you a charity or a not-for-profit?

Here are important issues to consider when fundraising

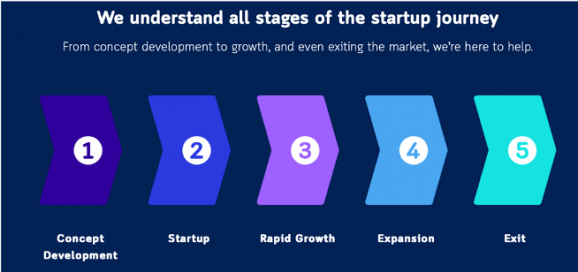

It is important for an organisation to comply with fundraising laws, otherwise the fundraising would be unlawful and legal penalties and reputational damage can result. Fundraising laws can be complex, and it is vital to have legal expert assistance to properly navigate them.

Identifying the jurisdictions’ fundraising laws

Each State has its own fundraising laws, this means that if you are fundraising in several States or Territories, or even fundraising online, the organisation will need to ensure that it complies with multiple jurisdictions’ fundraising laws. It is also useful to distinguish between ‘charity’ and ‘not-for-profit’, because some States have different regulations, depending on the organisation’s classification, when it comes to fundraising.

‘Not-for-profit’ means that any profit is not used for private gain but rather to further the goals of the organisation. Charity, in addition to being a not-for-profit, must also meet certain requirements such as having ‘charitable purposes’.

Regulations in the State of Victoria

In Victoria, the regulator is the Consumer Affairs Victoria (CAV) and fundraising is regulated by the Fundraising Act 1998 (Vic) and the Fundraising Regulations 2009 (Vic). There are a number of fundraising activities that are exempt from the regulations, these include:

- Memorial gifts;

- Fundraising for a patriotic fund;

- Receiving money from corporations, partnerships or trusts that are permitted to donate under their constitutive documents.

Organisations, in Victoria, intending to hold a fundraising, need to register as fundraisers. Registration is for three years, it is free of charge and in order to register the organisation needs to submit a number of forms and documents.

The Forms to be submitted include:

- Application for Fundraiser Registration or RenewalThis form asks the organisation for detailed information including:

- Personal details for the contact person;

- If the organisation is outside of Victoria, the nominated ‘Responsible Person’;

- Details of a ‘designated person’;

- The details and purpose of the fundraising activity;

- The distribution of the money and the beneficiaries;

- Bank account details;

- Appeal managers (persons who have managerial or financial responsibility for the fundraising activity) and associates(persons who have significant influence over the management and/or operation of the fundraising activity); and

- Details of any other fundraisers the organisation is working with.

- Criminal Record and Personal Insolvency DeclarationThis form is to be completed by:

- Key committee members of incorporated associations or all individual applicants;

- Persons nominated as appeal managers; and

- Persons nominated as associates.

Documents to be submitted include:

-

- Letter of consent from each new beneficiary other than the organisation;

- A copy of the company’s constitution, if it is a company limited by guarantee;

- A completed and signed Responsible Person Consent form, if it is an incorporated association incorporated outside of Victoria;

- The statement of purposes of the organisation and list of members including their:

- Names;

- Addresses; and

- Contact numbers.

A copy of the company’s constitution and Trust deed if applying as a Trustee for a Trust Fund.

Other requirements

if the organisation is based in another State or Territory but is registering as a fundraiser in Victoria, it would need to provide a Victorian address on the application form.

The application needs to be submitted at least twenty-eight days before the fundraising activity takes place. There is a possibility to submit an urgent application, but such applications are considered on a case-by-case basis. The organisation will receive a letter confirming the receipt of the application and if it is not contacted within twenty-one days by CAV from the date of the letter, the registration is considered to be successful. If on the other hand, the organisation disagrees with a decision made by CAV, it can appeal this within twenty-eight days to the Victorian Civil and Administrative Tribunal.Contact Allied Legal

The content of this article is an overview of the Victorian regulations on fundraising. Allied Legal’s lawyers in Melbourne can help you with these and other issues. We provide free 30-minute initial consultations to help understand your needs. Please contact us when you are ready to seek specialist advice: http://alliedlegal.com.au/contact/.