Here at Allied Legal, we believe that every startup should have access to reliable commercial advice. That’s why, commencing on Monday 25 May 2020, Allied Legal will be hosting a fortnightly complimentary 30-minute Zoom conference where attendees can check in and ask questions relating to their startup or venture.

Who are we?

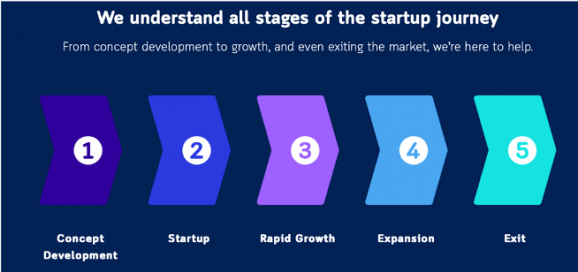

If you don’t know about us yet, Allied Legal specialises in providing legal and business development services to startups, scale-ups and innovative businesses. We operate out of Melbourne, Victoria but take a national approach to our practice.

Topics

Are you curious about what business structures are available to your startup? Has your revenue growth stagnated, and you’re wondering how to boost sales in a post-COVID world? Are you looking at expanding interstate? If you have questions about contracts, equity arrangements, scaling your business, or anything else relating to the legal and business development aspect of your startup, then come along to Allied Legal’s Live Streamed Startup Advice!

Details

Register your attendance at through the event on Facebook at: https://www.facebook.com/events/238000797464841/. There, you will find further details including the time and Zoom link for attendance. We can’t wait to see you and look forward to answering your questions!