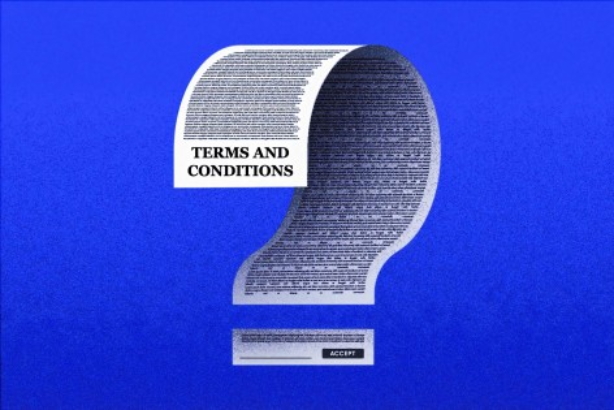

We’ve all encountered them. We’ve all accepted them. We’ve all been bound by them. But what are they and what do they do? If you have ever used a digital product or a website, chances are you’ve accepted terms and conditions. If your startup is involved in the tech space, then it’s time to think about what these documents contain, because you will need one before you can market your product to users.

Overview

Terms and conditions set out the terms of an agreement between two parties – the business that supplies the product or service, and the customer who is benefiting from the use of the product or service. Whereas most written contracts are formalised by both parties signing, in the case of online platforms, apps and websites, the terms and conditions are typically formalised by the customer ticking or clicking the “I Accept” box at the bottom of the screen, or simply by using the product or service.

Why are terms and conditions important?

Strictly speaking, a contract does not have to be written. Verbal contracts, often known as handshake agreements, can also be legally binding. That being said, a written agreement is in the best interests of both parties, as it provides the following:

- It sets out the terms on which you are providing your product or service.

- Having a contract in writing means that there is a document that both parties can use as a reference point as to what is expected from them under the contract. This way, there is no ambiguity around important terms such as fees, duration, or how the contract can be terminated.

- In the event that a dispute arises between the parties, having a contract in place makes it significantly easier to resolve the dispute, as a written contract will usually provide for what steps and mechanisms should be followed to resolve the dispute.

What should be included your startup’s terms and conditions?

While the form and content of your terms and conditions will depend on the nature of your startup, here are a list of key provisions that should always be addressed.

Fees and scope

Will you require customers to pay for your offering or will it be offered for free? Your terms and conditions should set out how much your customer is paying for your product or service, and how payment is to be executed. For example, is the service subscription based? If so, is the subscription paid weekly or monthly, and how will it be paid? Will you issue an invoice which will be payable within a set amount of time, or will you be direct debiting the fee payable? You should also consider whether you intend to charge a late payment fee or any interest on late payments.

Creation and termination

Your startup terms and conditions should set out provisions detailing how and when the contract is entered into, and under what circumstances it can be terminated by either party (if at all). Typically speaking, the contract is created by the customer accepting the terms and conditions or by using the product or service.

Termination can be a bit more complex. You should consider whether you want customers to be able to opt out of the agreement by the provision of notice (for example, with 30 days written notice), or whether they have to complete a set minimum period (such as 12 months) before being able to terminate. You should also consider whether you want rights in your favour to terminate the agreement in circumstances where the customer has committed a material breach of the terms and conditions, for example by not paying their fees on time.

Intellectual property

For any innovative business, chances are your most important asset is your intellectual property. A properly prepared terms and conditions for startups can help safeguard your intellectual property. By way of example, here are some key provisions that we commonly include in terms and conditions for startups to safeguard a businesses’ intellectual property:

- The customer’s purchase or use of the product or services does not assign any ownership rights in the intellectual property;

- The customer is not allowed to deal with the product or service in any way; and

- The user is not allowed to reverse engineer or otherwise replicate the product.

Disclaimers

A well put together startup terms and conditions should include:

- A disclaimer as to liability;

- Warranties (noting that some of these will be applied by Australian Consumer Law (ACL)); and

- What warranties and guarantees, if any, are made as to the functionality or quality of the product or service.

Note that to the extent that the ACL is applicable, there are certain statutory guarantees that may apply, such as safety requirements, or requirements that the product is fit for its purpose. Subject to the implication of warranties and ACL guarantees, most businesses will seek to limit their liability to the extent they can and will do so by applying appropriate disclaimers and indemnities within their startup’s terms and conditions.

Drafting terms and conditions for your startup

Here at Allied Legal, we frequently draft terms and conditions that are bespoke for specific startup’s needs. A good startup’s terms and conditions can mean the difference between your company being vulnerable and being protected. If you need terms and conditions prepared for your startup, give us a call on 03 8691 3111 or email us at hello@alliedlegal.com.au.