For many startup founders, due diligence feels like something that happens to them rather than something they can actively prepare for. It often arrives late in a funding round, can feel invasive, and sometimes exposes gaps in documentation, compliance, or governance.

From our experience working with founders, we see a lot of teams caught off guard at this stage. But the reality is that due diligence is not just an investor exercise. For founders, it’s an opportunity to protect the business, strengthen credibility, and significantly improve the chances of successfully raising capital, forming strategic partnerships, or executing an exit.

So What is Due Diligence?

At its simplest, due diligence is the process of checking that a startup is legally sound, financially accurate, and operationally viable. Investors, acquirers, and strategic partners use it to understand risk and confirm that the business in front of them matches the story being told.

For founders, it’s a different question: “If someone examined our business end-to-end today, would anything materially reduce trust or value?” Thinking about due diligence this way encourages founders to take control and actively prepare, rather than react at the last minute.

Why Due Diligence Matters for Founders

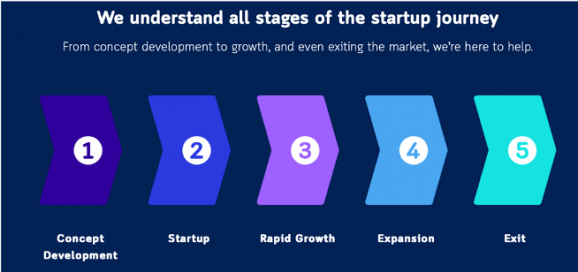

Many founders assume due diligence only becomes important at Series A or later, but in practice, it can appear much earlier. Angel and VC funding rounds, accelerator and incubator programs, strategic partnerships, and even enterprise customer onboarding often trigger formal reviews. M&A or acqui-hire discussions will also involve in-depth due diligence.

Being prepared can make a tangible difference. We see founders who are due diligence-ready:

- Speed up fundraising

- Improve valuation and terms

- Reduce last-minute legal costs

- Prevent deal-killing surprises

- Signal founder’s maturity and execution strength

Weak due diligence, on the other hand, is one of the most common reasons deals stall or collapse.

Core Areas of Due Diligence for Startup Founders

While the exact scope of due diligence varies depending on your startup’s stage and industry, we see most reviews focusing on a few consistent areas. Being prepared in these areas not only speeds up investor checks but also demonstrates that your business is well-run and trustworthy.

For more on what investors are looking for when funding early-stage companies, read our related article here.

Corporate due diligence is usually the first area investors examine. It confirms that the company legally exists and is properly governed. From our experience, getting this right from the start makes all subsequent reviews smoother and avoids early red flags.

Founders should be ready to show key documents and information, including:

-

Certificate of incorporation and company details

-

Constitution or replaceable rules

-

ASIC or equivalent filings kept up to date

-

Capital structure and share classes

-

Accurate cap table

We often see founders make common mistakes in this area. Informal equity promises that aren’t documented, early contributors or advisors holding shares without proper vesting, and inconsistencies between internal cap tables and official legal records can all create issues during due diligence.

Ultimately, corporate due diligence is not just about compliance—it’s a signal to investors that your startup is organised, professional, and ready for growth. For founders, preparing these materials early is one of the simplest ways to strengthen your credibility and protect the value of your business during investor conversations.

Founder, Equity, and Governance Due Diligence

While the scope of due diligence can vary depending on the stage and industry, most reviews focus on similar areas. Understanding these areas early allows founders to anticipate what will be checked and why.

Corporate Structure and Governance

Investors need to know that your company legally exists and is well-governed. This includes the company’s incorporation documents, constitution or replaceable rules, up-to-date filings, capital structure, cap table, and shareholder agreements.

From our experience, informal equity arrangements, advisors or early contributors holding shares without proper vesting, and inconsistencies between internal records and legal documents are common issues. Correcting these early builds confidence and prevents red flags during investor reviews.

Founder Equity and Governance

Investors back teams as much as products. Clear founder equity arrangements, decision-making authority, and governance structures signal maturity. When founders document vesting schedules, board composition, and drag-along or tag-along rights, it demonstrates long-term thinking and alignment among the leadership team.

We see a lot of value when founders treat these arrangements as more than paperwork—they reflect fairness, clarity, and professionalisation of the business.

Intellectual Property

For most startups, intellectual property (IP) is the core asset. Investors will look closely at ownership of software, code, designs, and content, and ensure that IP created by founders, employees, and contractors is properly assigned to the company.

High-risk scenarios often involve contractors without IP assignment agreements, code written before company incorporation, or IP developed at universities without proper licences. Open-source software compliance is also scrutinised. Clearly establishing ownership from the outset avoids deal-breaking issues later.

Employment and Contractor Compliance

Employment obligations can create hidden liabilities. Investors are concerned about employee vs contractor classification, employment agreements, compliance with minimum wage and superannuation obligations, and any risks related to employee share schemes or termination.

We see founders often underestimating this area. Proactively addressing employment compliance and contractor arrangements reduces risk and builds investor confidence.

Regulatory, Licensing, and Privacy Considerations

Depending on your industry, regulatory compliance can be a major focus of due diligence. Fintech, health, education, marketplaces, crypto, and digital asset startups often face deeper scrutiny. Investors will look at licences, regulatory compliance history, consumer law obligations, and your approach to privacy and data protection.

Even early-stage companies benefit from demonstrating that they understand regulatory requirements and have plans to maintain compliance as they scale. Similarly, showing robust privacy and cybersecurity practices can set a startup apart, especially when sensitive personal data is involved.

Commercial Contracts and Financials

Investors also want to understand what the company is contractually committed to and the financial health of the business. Key areas include major customer and supplier contracts, revenue concentration, termination clauses, financial statements, tax compliance, and any outstanding debts or obligations.

Transparent, conservative financial reporting builds trust. We see a lot of founders underestimate how much clarity on contracts and financials can influence investor perception and speed up funding discussions.

Risk, ESG, and Reputation

Finally, investors are increasingly reviewing environmental, social, and governance (ESG) considerations, particularly in later-stage rounds. Ethical supply chains, governance practices, AI and data ethics, and founder reputation can all impact due diligence outcomes.

Even if your startup isn’t large enough for formal ESG reporting, demonstrating awareness and intention signals strong leadership and responsibility.

How Founders Can Prepare

Preparation is key. We advise founders to start well before a funding round. Maintaining a structured data room that includes corporate documents, cap tables, IP assignments, contracts, financials, and policies ensures that information is accessible and up to date.

Being transparent about risks is equally important. Strong founders frame due diligence as a conversation about known risks, mitigation strategies, and clear post-investment plans. Surprises are the biggest deal killers, while openness builds confidence.