Allied Legal’s commercial and startup lawyers are regularly consulted about the legal ramifications of “flipping up”. So what is a flip up? Broadly, it’s redomiciling or, put simply, moving your business to a foreign jurisdiction (however, please keep reading as we clarify this further). In the startup and, more specifically, the tech context, that foreign jurisdiction tends to be the US given it’s a larger market (i.e. useful for driving increased sales), an innovation haven and because investment can be easier to source in the US (please note that these are broad generalisations). We are also seeing jurisdictions such as Singapore, Hong Kong and the United Kingdom becoming increasingly attractive destinations.

To the extent that you seek foreign investment or your product or service is better suited to a foreign jurisdiction you will need to consider such “flip ups”. From the perspective of a foreign investor, they are far more comfortable investing in a company which is based in their local jurisdiction (Australia is a long way away!).

Flip-up ABCs

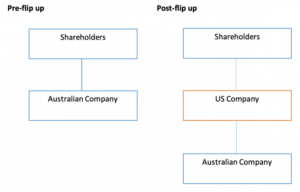

Broadly, flip ups are implemented by interposing a foreign company (usually in the US) between the Australian company and its shareholders (see illustration below).

From the shareholders’ perspective, shares in the Australian company are exchanged for shares in the US company. The Australian company becomes wholly owned by the US parent company. From the shareholders’ perspective, they continue to hold their interest in the Australian company, albeit indirectly via the US parent. As such, the flip up effectively “moves” the business to the US.

Tax Considerations

There are various tax implications associated flip ups and tax advice should be sought at an early stage. Tax considerations include:

- Whether there are immediate CGT implications associated with the disposal of the shares in the Australian company? Under certain circumstances, rollover relief may be available which could defer immediate CGT implications.

- Potential tax implications could be triggered if existing assets of the Australian company are moved to the foreign entity. Moving assets of value between companies (including valuable IP) can trigger tax implications. A common means of avoiding such implications could be for the Australian company to grant rights to the foreign company allowing the foreign company to use the assets via a licencing arrangement (i.e. but the assets themselves are retained by the Australian company).

- There are other potential complex implications that can be triggered if the flip up is not structured properly. This includes complex Australian tax implications associated with “passive entities”. Again, tax advice should be sought to mitigate such issues.

- There will of course also be foreign tax implications associated with operating in the foreign jurisdiction itself post flip up. Generally speaking, tax friendly jurisdictions such as Delaware (US) are commonly chosen in flip up transactions as these are particularly friendly from a tax perspective.

Legal Considerations

As is evident from the above, flip ups trigger various legal issues. A lawyer should accordingly be engaged early. In addition to advising on how to implement the flip up, lawyers are needed to prepare the legal documentation required to (among other things), transfer shares (commonly referred to as share swap agreements) and to ensure appropriate licencing arrangements are put in place between the Australian company and new foreign company.

So Should I Flip Up?

As stated above, flip ups are implemented to provide Australian companies with access to foreign market and their investors. These markets may provide access to a greater depth of expertise, investors, sales and knowledge.

However, you should always be wary that flip up transactions are complex and difficult to unwind. They also require time and money to be spent on consultants who will help you implement the transaction “correctly”. Accordingly, the overall decision will be highly commercially driven and where you and your company are in your “business lifecycle” will determine whether a foreign jurisdiction is right for you.

Need Help? Contact Us

At Allied Legal we help startups and scale ups implement flip ups. We cannot stress enough that competent legal advice is critical when it comes to successfully implementing such transactions. If you want to know more about how we can help, give us a call on 03 8691 3111 or send us an email at hello@alliedlegal.com.au.